2025 Housing Market Insights

How Mortgage Rates and Home Prices Can Impact Your Homeownership Goals

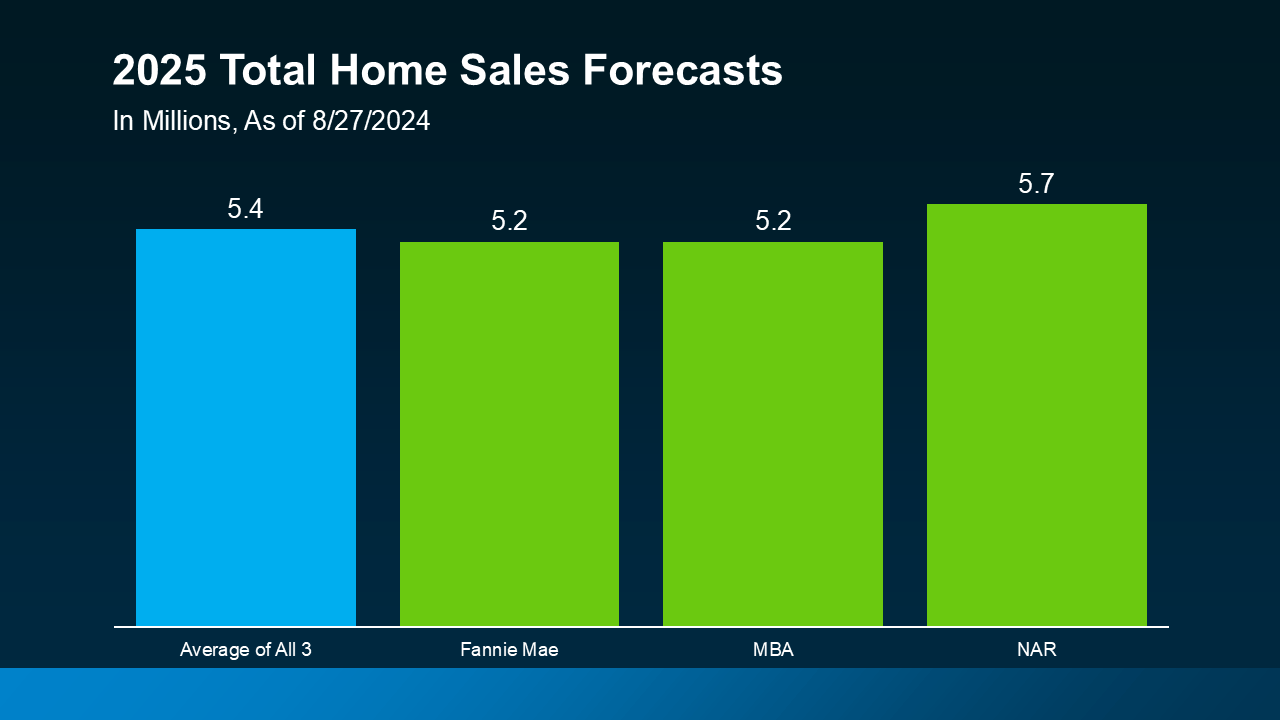

As we approach 2025, the question on every prospective homebuyer and seller’s mind is: What can we expect from the housing market? The projections from leading experts offer a cautiously optimistic outlook, emphasizing slight declines in mortgage rates and steady, if slower, home price growth. Here’s a breakdown of the current projections on mortgage rates, home sales, and prices to help you make well-informed decisions about your homeownership plans in 2025.

Mortgage Rates Are Projected to Decline Slightly

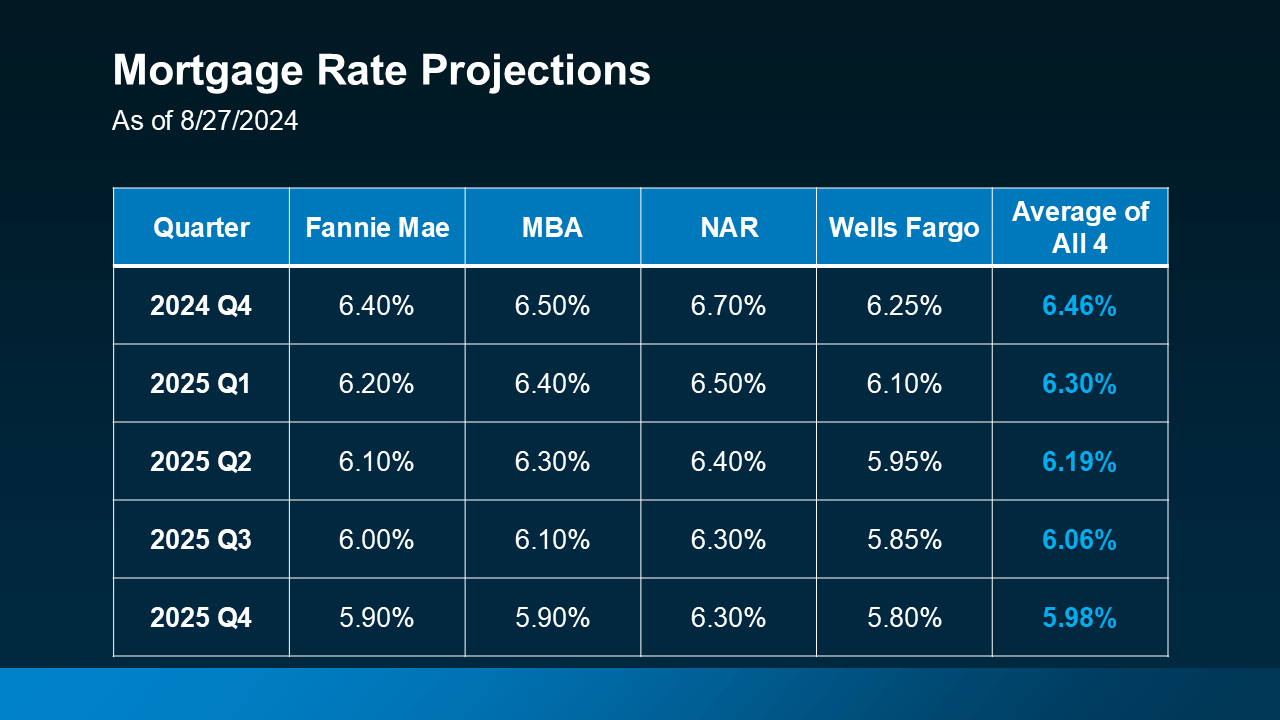

The mortgage rate forecast for 2025 is a glimmer of good news, especially given the recent highs in borrowing costs. According to estimates from critical institutions like Fannie Mae, the Mortgage Bankers Association (MBA), the National Association of Realtors (NAR), and Wells Fargo, mortgage rates will gradually ease over the next year. While not drastic, this gradual decline could significantly improve affordability, opening doors for more buyers to enter the market or for current homeowners to refinance.

A drop in mortgage rates offers a potential boost in purchasing power for anyone considering homeownership or a real estate investment. Lower rates can mean a reduction in monthly mortgage payments, which might allow you to explore options in a higher price range or lock in a better deal on a desired property.

What’s Happening with Home Prices?

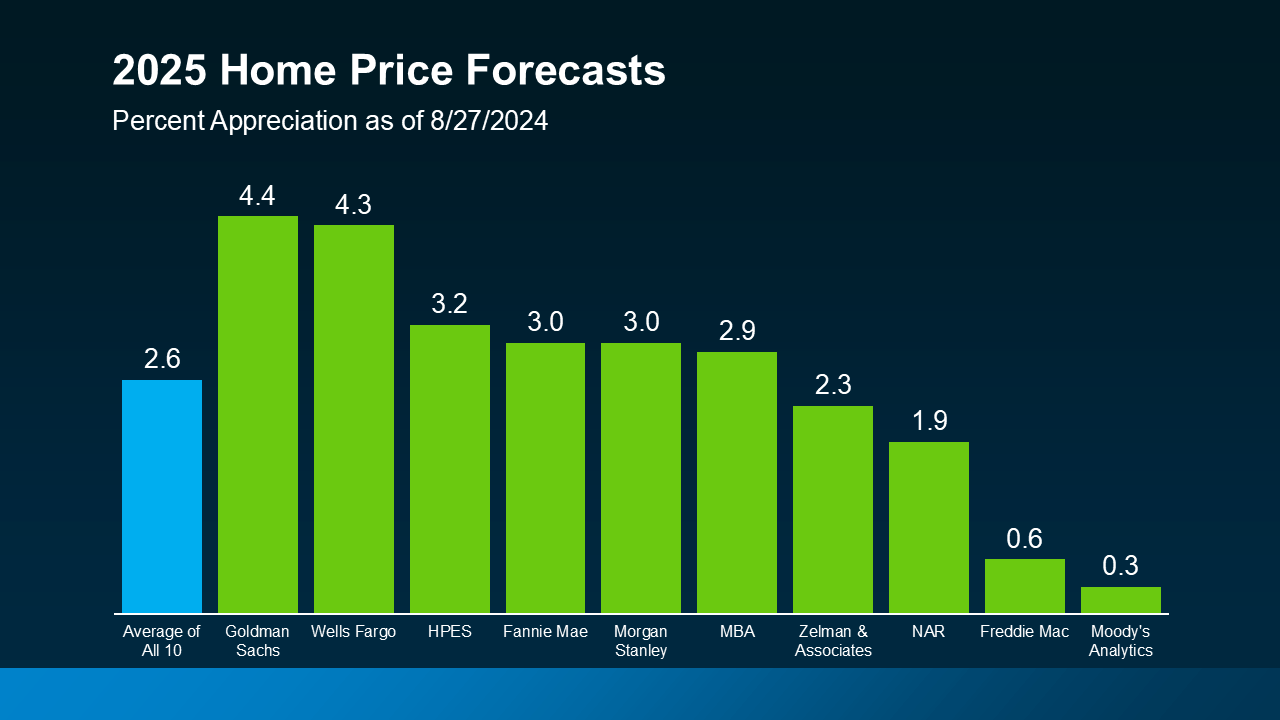

Despite cooling trends, home prices are still anticipated to rise more moderately. On average, experts predict home prices will increase nationally by about 2.6% in 2025. This projected growth is noticeably lower than the steep increases seen in previous years, marking a return to a more balanced market. The report notes, “Experts agree that home prices will continue to increase moderately next year at a slower, more normal rate.”

However, it’s essential to remember that price changes are not one-size-fits-all. Regional and local market factors—like job growth, population shifts, and housing inventory—will shape price trends in each area. As a result, while some markets might see robust gains, others could experience more stability or minimal changes.

Navigating the Market in 2025

Understanding these market dynamics is critical to making the right moves for your unique real estate goals. Whether you’re planning to buy your first home, upgrade to a larger space, or sell, having insight into trends like mortgage rates and home price projections can help you position yourself advantageously. If you’re a buyer, remember that a slight dip in mortgage rates could stretch your purchasing power further. For sellers, moderate price growth means you’re likely to see solid returns, though pricing competitively will remain essential for a quick sale.

As we head into 2025, “having a clear picture of what [the experts] are calling for can help you make the best possible decision for your homeownership plans.” Staying informed about these projections isn’t just about knowledge; it’s about timing and strategy.

Bottom Line

The housing market in 2025 offers a promising blend of affordability and growth, setting the stage for potential opportunities for buyers and sellers alike. Understanding these forecasts can help you make more confident decisions about the road ahead.

Let’s connect to discuss how these projections could impact your 2025 real estate goals. Whether you’re looking to capitalize on better mortgage rates, invest in a property, or list your home, we’re here to help you make the most of what’s ahead in the housing market.

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "

104 West 40th Street 4th Floor, New York, NY, 10018, USA