Discover New York-Specific Down Payment Assistance Programs

What is Down Payment Assistance?

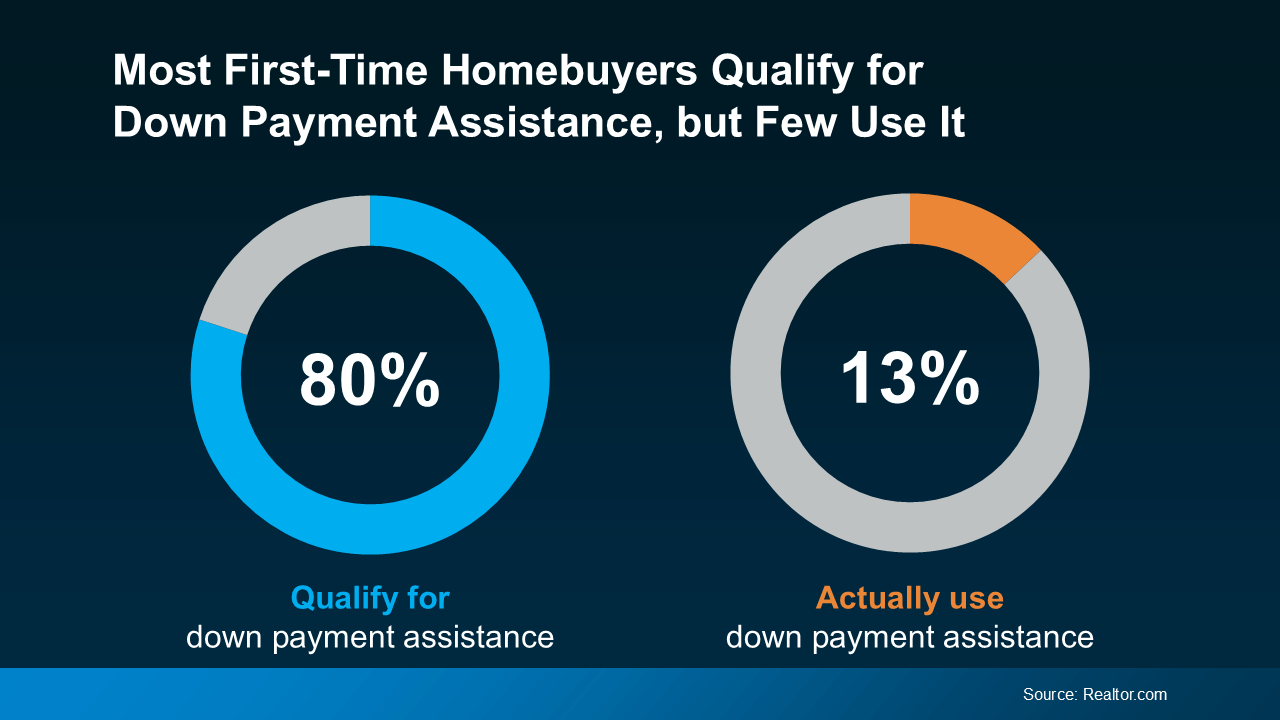

Down Payment Assistance (DPA) programs help buyers cover part or all of their down payment and closing costs. These programs include loans or grants from government agencies, non-profits, and private lenders. More than 2,000 DPA programs are available nationwide, including several programs designed specifically for buyers in New York.

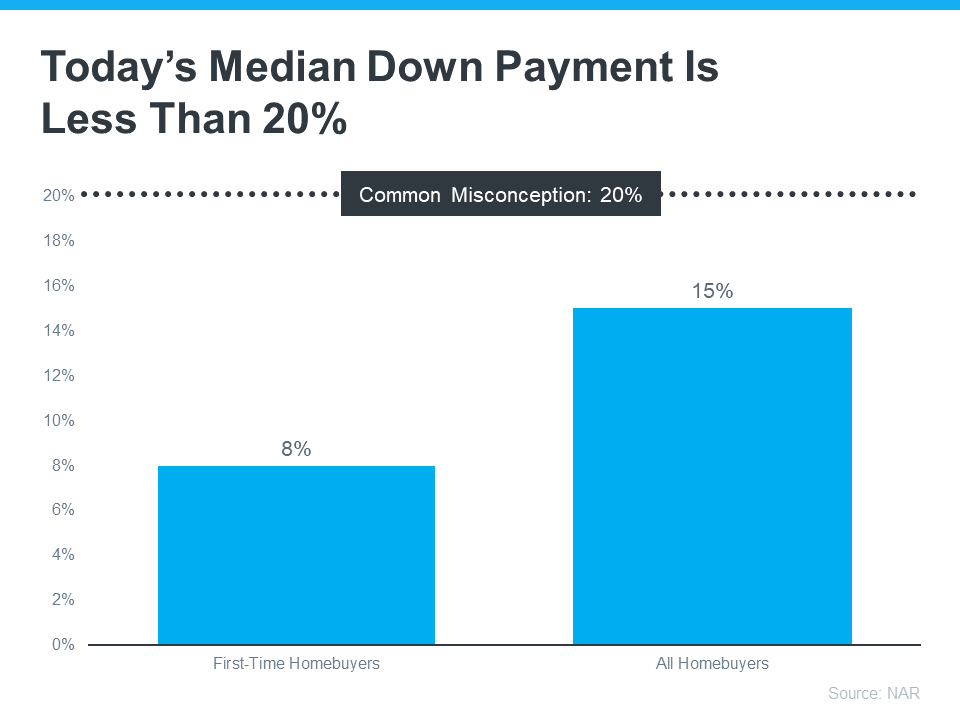

Contrary to popular belief, you don't need to save a 20% down payment to buy a home. The average down payment for first-time buyers is just 8% of the home's purchase price, and some programs allow qualified buyers to pay as little as 3% or even 0% upfront.

Localized Down Payment Assistance Programs in New York

If you're purchasing a home in New York, you can access several programs that provide significant financial assistance for your down payment and closing costs.

Here are a few that are particularly useful for New York buyers:

- State of New York Mortgage Agency (SONYMA): SONYMA offers Down Payment Assistance Loans (DPAL), which provide eligible borrowers with a loan of up to 3% of the purchase price (up to $15,000) to help with their down payment or closing costs. This loan may be forgiven if the buyer stays in the home for at least (10) ten years, making it an excellent option for long-term residents.

- New York City HomeFirst Down Payment Assistance Program: For buyers looking to purchase in New York City, the HomeFirst program provides qualified first-time buyers with a grant of up to $100,000 to assist with down payment and closing costs. To qualify, buyers must complete a homebuyer education course and meet income and purchase price limits based on family size and the area of New York City in which they're buying.

- Neighborhood Housing Services of New York City (NHS NYC): NHS NYC offers a range of homebuyer assistance programs, including grants and loans to help cover down payment and closing costs for eligible buyers. These programs often target specific New York City neighborhoods where home prices may be out of reach for many first-time buyers.

- Homebuyer Dream Program (HDP): This program, available through participating New York banks, provides first-time homebuyers with grants of up to $10,000 for down payment and closing cost assistance. The program targets moderate-income buyers who meet specific income requirements and is available throughout New York State.

- Federal Home Loan Bank of New York First Home Club: This program provides matching grants for buyers who save for their down payment. For every dollar saved (up to $1,875), the program will match it with $4, providing a total of $7,500 toward the buyer's down payment.

Steps to Apply for Down Payment Assistance in New York

Here's a step-by-step breakdown of how to apply for down payment assistance programs, including those specific to New York:

1. Assess Your Eligibility

For New York-specific programs like SONYMA and HomeFirst, check if you meet the basic qualifications, such as being a first-time homebuyer, meeting income limits, or buying in specific areas. SONYMA, for example, has income limits that vary by county, and HomeFirst has purchase price limits based on the borough.

2. Complete a Homebuyer Education Course

Many programs, including the HomeFirst Down Payment Assistance Program, require you to complete a homebuyer education course from a HUD-certified counselor. This step is essential in understanding the responsibilities of homeownership and the financial obligations involved.

3. Research and Apply for Local Programs

Use resources like SONYMA and Down Payment Resource, or speak with a housing counselor to determine which New York-specific programs you may qualify for. Each program has different criteria and benefits, so take the time to explore all your options. Many programs are limited to specific geographic areas or buyer profiles (e.g., first-time buyers and certain income levels).

4. Prepare Your Financial Documents

Be sure to gather essential documents such as proof of income, credit history, employment records, and recent tax returns. These will be necessary for determining eligibility, especially for income-based programs like SONYMA and HomeFirst.

5. Apply and Work with a Local Lender

Many of New York's down payment assistance programs have approved lender networks. Work with a lender familiar with these programs to ensure you get assistance. They'll help you through the application process and combine your down payment assistance with an appropriate mortgage product.

6. Finalize Your Home Purchase

After receiving approval for down payment assistance and securing a mortgage, you'll move to the final stages of closing on your home. New York's programs, like SONYMA and HomeFirst, offer significant assistance with closing costs, reducing the financial pressure on buyers.

Maximize Your Down Payment Potential

In New York, first-time buyers and those eligible for local programs can leverage options that require as little as 3% down or, in some cases, 0%. Combining state and city programs with national assistance programs can dramatically lower out-of-pocket costs.

For instance, a New York City buyer using the HomeFirst grant and SONYMA's Down Payment Assistance Loan could secure a home with far less upfront cash than they might have anticipated.

Don't Let Headlines Scare You

While New York's real estate market can be intimidating, with high property prices and increased demand, don't be discouraged. The average down payment required for many loan programs has not changed. With the right assistance program, buyers can get into homes with much less than they think. The key is knowing where to look and accessing these valuable programs.

The Bottom Line

If you're looking to buy a home in New York, down payment assistance programs are a powerful tool to help you lower your upfront costs and achieve homeownership. By working with a trusted lender, you can access programs that offer significant financial assistance—especially in high-cost areas like New York City.

Ready to Start?

Don't let the high cost of homes in New York discourage you. With so many down payment assistance programs available—whether it's through SONYMA, HomeFirst, or other local programs—you can reduce your financial burden and move into your dream home. Find down payment assistance programs in your area today - Check If You're Eligible - to start your journey toward homeownership.

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "

104 West 40th Street 4th Floor, New York, NY, 10018, USA